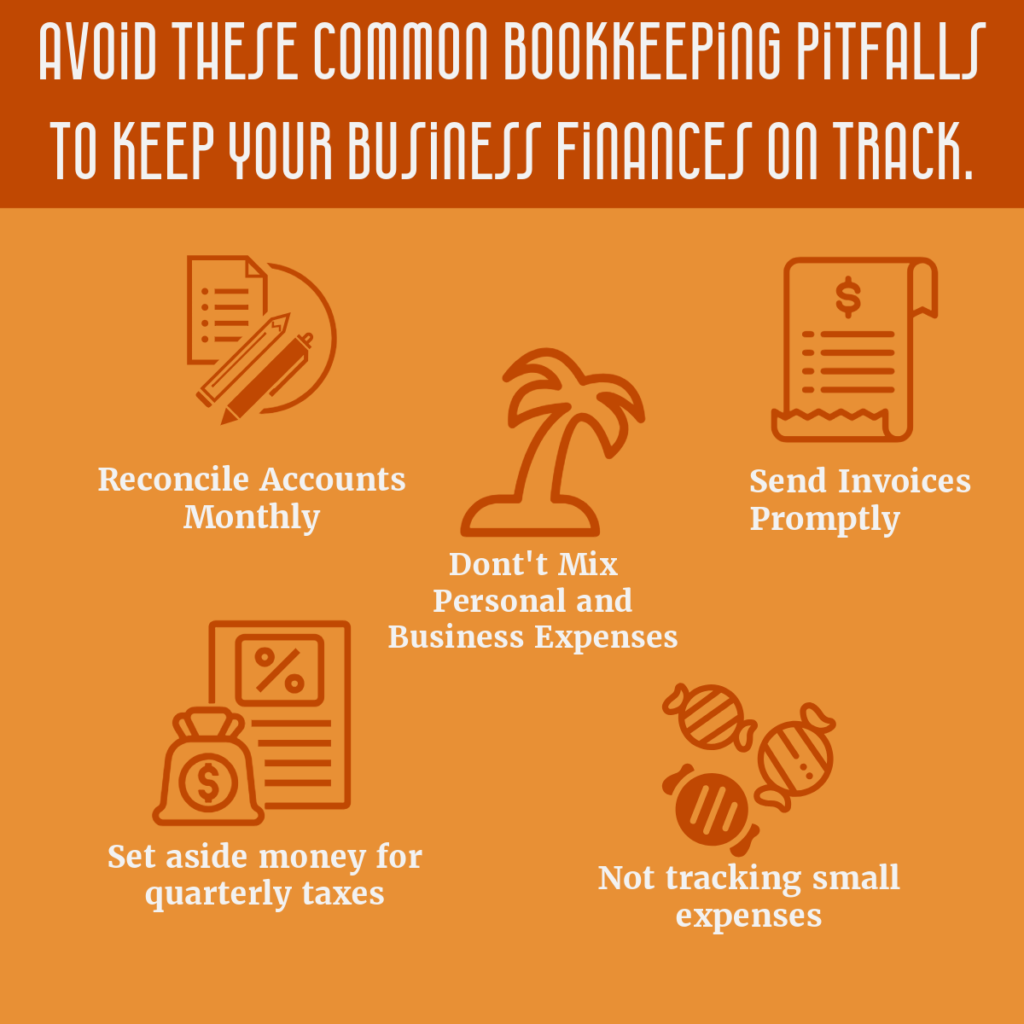

6 Bookkeeping Mistakes Small Businesses Often Make (And How to Avoid Them)

As a small business owner, you wear many hats. From CEO to janitor, you do it all. But one role you can’t afford to neglect is that of bookkeeper. Proper financial management is crucial for the success and growth of your business. Unfortunately, many small businesses make common bookkeeping mistakes that can lead to financial headaches down the road. In this post, we’ll explore six of these mistakes and provide practical tips on how to avoid them.

1. Mixing Personal and Business Finances

One of the biggest mistakes small business owners make is failing to separate personal and business finances. This can lead to confusion come tax time and may even put your personal assets at risk.

How to Avoid It:

- Open a separate business bank account and credit card

- Use your business account for all business-related transactions

- Keep personal expenses separate, even if you plan to reimburse yourself later

2. Neglecting to Track Small Expenses

It’s easy to overlook small expenses like coffee meetings or office supplies, but these can add up quickly and impact your bottom line.

How to Avoid It:

- Keep all receipts, no matter how small

- Use a mobile app to scan and categorize receipts on the go

- Review your expenses regularly to identify areas where you can cut costs

3. Procrastinating on Bookkeeping Tasks

When you’re busy running your business, it’s tempting to put off bookkeeping tasks. However, this can lead to a backlog of work and increase the likelihood of errors.

How to Avoid It:

- Set aside dedicated time each week for bookkeeping tasks

- Use cloud-based accounting software to streamline processes

- Consider outsourcing to a professional bookkeeper if you’re consistently falling behind

4. Inadequate Tax Preparation

Many small businesses struggle with tax preparation, often scrambling at the last minute or missing out on potential deductions. This can result in overpaying taxes or facing penalties for errors.

How to Avoid It:

- Keep detailed records of all income and expenses throughout the year

- Set aside money for taxes regularly to avoid cash flow issues when it’s time to pay

- Stay informed about tax deductions relevant to your industry

- Consider working with a tax professional to ensure compliance and maximize deductions

5. Not Reconciling Accounts Regularly

Failing to reconcile your accounts with bank statements can lead to discrepancies and make it difficult to get an accurate picture of your financial health.

How to Avoid It:

- Reconcile your accounts at least monthly

- Use accounting software that can automatically import bank transactions

- Investigate any discrepancies immediately

6. Improper Invoice Management

Poor invoice management can lead to cash flow issues and make it difficult to track what you’re owed.

How to Avoid It:

- Send invoices promptly

- Use invoicing software to automate reminders for overdue payments

- Keep detailed records of all invoices sent and payments received

By avoiding these common bookkeeping mistakes, you can ensure that your financial records are accurate, up-to-date, and compliant with tax regulations. Remember, good bookkeeping practices not only help you stay organized but also provide valuable insights into your business’s financial health, enabling you to make informed decisions for growth and success.

Need help getting your books in order? Our professional bookkeeping services can take the stress out of financial management, allowing you to focus on what you do best – running your business. Contact us today to learn more!